Triple Net Banks For Sale Nationwide

Bank of America - Staten Island 5.42% CAP | 3,483 SF | STATEN ISLAND, NY

3881 Richmond Avenue, Staten Island, NY 10312 Asking Price :$ 4,500,000

LEE is pleased to offer for sale the fee simple interest in a single-tenant, freestanding Bank of America (the “Property” or “Asset”) located in Staten Island, New York. Situated at the intersection of Amboy Road and Richmond Avenue, the Asset is subject to an absolute triple net (“NNN”) lease to Bank of America, National Association (the “Tenant”), a wholly owned subsidiary of Bank of America Corporation, which carries an investment grade ‘A+’ rating from S&P credit rating agency. The Property is strategically positioned proximate to both the Eltingville Shopping Center and the Eltingville Train Station, benefiting from commuter and local traffic in the area. This offering represents an exceptional opportunity to acquire an asset located in an area boasting impressive population density surrounded by rational retailers, leased to one of the premier tenants in the net lease investment market.

Property Type Retail Investment Type Net Lease Lease Type NNN Tenant Credit Credit Rated Tenancy Single

Lease Expiration 07/31/2034 Remaining Term 14.7 years Square Footage 3,483 Price/Sq Ft $1,291.99

Cap Rate 5.42% NOI $244,000 Year Built 2014 Rent Bumps 3% Lease Options 2, 10-year Courtesy of JLL

Chase Bank 4.86% CAP | 2,725 SF | PINE BUSH, NY

Asking Price: $750,000 Lease Type NNN

Tenant Credit Credit Rated, Corporate Guarantee Tenancy Single

Lease Expiration 03/31/2020 Remaining Term 0.3 years

Square Footage 2,725 Price/Sq Ft $275.23 Cap Rate 4.86%

Pro-Forma Cap Rate 5.10% NOI $36,447 Pro-Forma NOI $38,268

Lot Size (acres) 0.87 Parking (spaces) 27 Lease Options One 5-Year

Ownership Fee Simple Courtesy of Marcus Milliachap

Keybank 6.74% CAP | 3,540 SF | LAKEWOOD, NY

Asking Price: $2,443,970

Sub Type Net Leased Bank Lease Type Absolute NNN

Tenant Credit Corporate Guarantee, Credit Rated

Tenancy Single Lease Term 18 years

Lease 05/31/2007 - 05/30/2025 Remaining Term 5.5 years

Square Footage 3,540 Price/Sq Ft $690.39

Cap Rate 6.74% NOI $164,817 Zoning 5 Lot Size (acres) 0.59

Lease Options 3(5) Year Options Ownership Fee Simple By MM

1100 Kings Highway 25,399 SF HOMECREST, NY

Asking Price: $37,500,000

Property Type Retail, Development Site Tenancy Multi Square Footage 25,399 Price/Sq Ft $1,476.44 Stories 1

Zoning C4-4L / R7A / C2-3 Lot Size (sq ft) 19,459

- Subject property is a single-story retail property that spans 251.47’ x 108.67’, with total gross square footage of 43,180.

- Property includes J.P. Morgan Chase and Dress Barn as tenants along Kings Highway, generating a gross income of over $1.4 million annually.

- Departing tenants at the rear tax lot of the property along Kings Highway would allow developer to build up to 75,400 SF with an additional 14,977 SF of air rights as-of-right, including the combined BSF from the corner tax lot.

- Kings Highway and Coney Island Avenue are two of Southern Brooklyn’s busiest corridors and major thoroughfares, which sees approximately 38,000 vehicles passing daily at this intersection.

- Located in an area that is surrounded with many other national retailers such as Walgreens, Santander, CitiBank, TD Bank, Northfield, Capital One, 24 Hour Fitness, City MD, Chipotle, Starbucks, and Aldo Shoes.

- The site would be eligible for Affordable NY (421a), offering a 35-year tax abatement with 30% of the units rented at 130% AMI.

- Public transportation are available via the B Q trains, located at express Kings Highway station and B7, B68, B82, and B82 Select-A-Bus lines available conveniently in front of the property. Courtesy of B6 Real Estate Advisors

Chase Bank 4.20% CAP | 4,500 SF | BALDWIN, NY

Asking Price: $4,200,000

Lease Type NNN Tenancy Single Remaining Term 10 years

Square Footage 4,500 Price/Sq Ft $933.33 Cap Rate 4.20%

Zoning Business District(X) Lot Size (sq ft) 47,480

Parking (spaces) 42 Lease Options Two Five Year Options

- $175,450 Net Operating Income

- 10% Rent Increase Every Five Years

- 10 Years Remaining on The Lease

- Corporate Guarantee

- Two Five Year Options

- 4,500 Square Foot Single Tenant Building

- 47,480 Square Foot Lot

- 42 Parking Spots

- Two Curb Cuts on Grand Avenue

- One Drive-up Teller

- One Drive Up ATM

- 31,773 Cars Per Day

- $106,602 Median Household Income

- by ERG Commercial Real Estate

Bank of America & Shoppes (2260 Broadway) UPPER WEST SIDE MANHATTAN, NY

Asking Price: $42,000,000 Property Type Retail Tenancy Multi

Square Footage7,954 Cap Rate 5.78% Occupancy 100% NOI $2,425,719

Year Renovated 2008 Ownership Fee Simple

Faris Lee Investments is pleased to offer for sale a rare opportunity to acquire the fee simple interest in a three (3)-tenant high street retail asset, Bank of America and Shoppes (the “Property), located along one of the world’s most well-known and highly trafficked streets, BROADWAY, in the Upper West Side (UWS) of Manhattan, New York. Bank of America is an investment grade tenant (S&P A-), representing 88% of the assets NOI and features an unprecedented 52 feet of grandfathered frontage along Broadway. Cedra Pharmacy is a high-end retail operator that was founded by Duane Reade (Walgreens subsidiary) pharmacists, and The Eye Man has successfully operated at the property since 1977. Both Tenants have established businesses and are ideally suited for the Upper West Side demographics. Cedra Pharmacy & The Eye Man are paying below market rents and feature strong rental increases, providing upside to an investor. The street front condominium aspect of the Property minimizes management responsibilities, as there’s no parking lot, roof, or structure to maintain; providing a friction-free real estate investment.

Bank of America Portfolio 6.30% CAP | 53,492 SF | FAIR LAWN, NJ

Asking Price: $11,330,000

Address (2 locations)

13-14 River Rd, Fair Lawn, NJ 07410 & 101-103 South Rd, Cranford, NJ 07016

Property Type Retail Investment Type Net Lease Tenant Credit Corporate Guarantee Tenancy Single

Square Footage 53,492 Price/Sq Ft $211.81 Cap Rate 6.30% Occupancy 100% NOI $713,900 Units 2 Year Built 2010 Buildings 2 Stories 1

Lot Size (acres) 1.19 Parking (spaces) 48 Ground Lease Yes Ownership Fee Simple

- Rare NJ Credit Tenant Ground Lease – Zero Landlord Responsibilities

- 10% Rent Increases Every 5 Years (20% in Options)

- Bank of America is Rated BBB+ by Standard & Poor's (Investment Grade Credit)

- Premium Northern New Jersey Demographics – Over $153K Household Income Within 1 Mile and Over 427K People Within 5 Miles

- Nearby National Retailers Include CVS, Advance Auto Parts, 7-Eleven, McDonald’s, Home Depot & Walgreens Courtesy of Marcus Millichap

BB&T 5.50% CAP | 1,650 SF | VINELAND, NJ

Asking Price: $1,020,000

Property Type Retail Lease Type Absolute NNN

Tenant Credit Corporate Guarantee, Credit Rated

Tenancy Single Square Footage 1,650 Price/Sq Ft $618.18

Cap Rate 5.50%NOI $56,091 Year Built 1973 Zoning R-4

Lot Size (acres) 0.78 Parking (spaces) 10

Rent Bumps 2% Annual APN 04-00122-0000-00032

Ownership Fee Simple Courtesy of SRS National Net Lease Group

Chase Bank -WOODBRIDGE TOWNSHIP, NJ

Asking Price: $6,352,941

Investment Type Net Lease Lease Type Absolute NNN

Tenant Credit Credit Rated, Corporate Guarantee

Tenancy Single Lease Term 20 years

Rent Commencement 01/15/2020 Net Rentable (sq ft) 3,022

Cap Rate 4.25% Occupancy 100% NOI $270,000 Year Built 2020

Rent Bumps 10% every 5 years Lease Options Four, 5-year options

Ground Lease Yes Courtesy of Stream Capital Partners

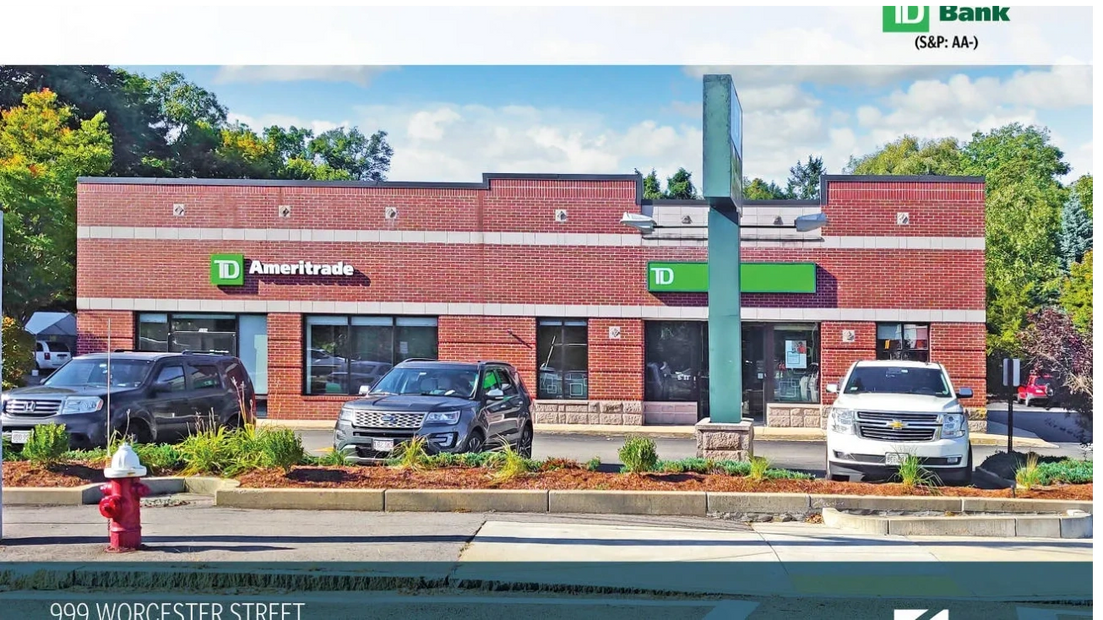

TD Ameritrade & TD Bank 5.20% CAP | 5,879 SF | WELLESLEY, MA

Asking Price: $4,800,000

Property Type Retail Lease Type NNN

Tenant Credit Credit Rated, Corporate Guarantee Tenancy Multi Number of Tenants 2 Square Footage 5,879 Cap Rate 5.20% NOI $249,661

Zoning Commercial Lot Size (acres) 0.68 Parking (spaces) 35 APN WELL-000200-000027 Ownership Fee Simple

The SRS National Net Lease Group is offering the rare opportunity to acquire the fee simple interest (land and building), in a freestanding, two-tenant building occupied by national tenants located in the affluent suburb of Wellesley, MA, (Boston MSA). The building is currently occupied by TD Bank (corporate | S&P: AA-), and TD Ameritrade (corporate | NASDAQ: AMTD), both which are operating on new 10 year leases. Both leases feature rare 10% rental increases in year 6 and at the beginning of each option period, growing NOI and hedging against inflation. As of June 30, 2019, the TD Bank has strong deposits north of $110 MM. Additionally, all the tenants are on net leases, reimbursing for taxes, insurance, and CAM, limiting expense leakage for an investor. Landlord is responsible for roof, structure, and common area maintenance (all expenses subject to reimbursement by tenants). TD Bank is paying well below market rent and features a large 32% rental increase at the beginning of its first option period.

Bank of America - Parsippany, New Jersey 4.00% CAP 3,276 SF PARSIPPANY-TROY HILLS, NJ

Asking Price: $8,125,000

Investment Type Net Lease Class A Lease Type NNN

Tenant Credit Corporate Guarantee Tenancy Single

Lease Term 15 years Lease 02/01/2016 - 01/31/2031

Remaining Term 11.2 years Square Footage 3,276 Price/Sq Ft $2,480.16 Cap Rate 4.00% Occupancy 100% NOI $325,000 Year Built 2016 Buildings 1 Stories 1 Lot Size (acres) 0.9 Parking (spaces)35 Rent Bumps 12% Every 5 Years Lease Options 3 @ 5 Years Each Invest Commercial

Santander Bank 6.00% CAP 3,716 SF NORWOOD,MA

Asking Price: $2,083,333

Investment Type Net Lease Lease Type Absolute NNN

Tenant Credit Corporate Guarantee Tenancy Single

Lease Expiration 06/29/2025 Remaining Term 5.6 years

Square Footage 3,716 Price/Sq Ft $560.64

Cap Rate 6.00% NOI $125,000

Units 1 Lot Size (acres) 0.47

Lease Options5-5 Year Options

Ownership Fee Simple - Horvath & Tremblay

SunTrust Bank | South Boston, VA 6.50% CAP | 7,857 SF | SOUTH BOSTON, VA

Asking Price: $1,832,492

Property Type Retail Lease Type Absolute NNN Tenancy Single Remaining Term 10 years

Square Footage 7,857 Price/Sq Ft $233.23 Cap Rate 6.50% NOI $119,112 Units 1

CBRE is pleased to exclusively present for sale this SunTrust Bank located on Main Street in South Boston, Virginia. This is an absolute NNN lease with no landlord responsibilities or expenses. SunTrust has been operating at this location since 2010 and currently has over 10 years remaining in its initial 20 year lease. There are rare 1.5% annual rental increases in the base term of the lease and in each of the six, five year options. The lease is corporately guaranteed by SunTrust Banks, Inc., a publicly traded, investment grade credit tenant rated A- by Standard & Poor's. This passive ownership offering, combined with a highly financeable small price point makes this an easily attainable investment property for the future owner.

This larger than average 7,857 square foot bank sits on 0.80 acres with three drive-thru lanes and ample parking. The property has excellent visibility along Main Street with 18,000 vehicles traveling by daily. The property also has visibility and access on Factory Street, Charles Street and Ferry Street. There are minimal national banks within a 1 mile radius of this site making it a go-to bank for surrounding residents and businesses. Surrounding uses include local restaurants, hardware stores, medical offices, and clothing stores. There are 3,367 people within 1 mile, 9,356 people within 3 miles and 13,876 people within 5 miles. South Boston is a town in Halifax County, just north of the North Carolina border, in the middle of the state of Virginia.

SunTrust Bank 5.65% CAP 2,687 SF VIRGINIA BEACH, VA

Asking Price: $2,778,761

Property Type Retail Investment Type Net Lease

Lease Type Absolute NNN Tenancy Single

Lease Expiration 09/30/2028 Remaining Term 8.8 years

Square Footage 2,687 Price/Sq Ft $1,034.15

Cap Rate 5.65% NOI $157,000 Units 1 - The Boulder Group

SunTrust Bank 5.75% CAP 2,250 SF FREDERICKSBURG, VA

Asking Price: $2,765,619

Investment Type Net Lease Lease Type NNN Tenancy Single

Lease Expiration 12/31/2027 Remaining Term 8.1 years

Square Footage 2,250 Price/Sq Ft$1,229.16 Cap Rate 5.75%

NOI $159,023 Lot Size (acres) 0.9 Rent Bumps 1.5% Annually

Lease Options Six, Five-Year options - Marcus & Millichap

Chase Bank: Kensington, MD 4.50% CAP NEWLY-EXECUTED LONG-TERM NNN LEASE WASHINGTON D.C.

Asking Price: $6,125,000

Property Type Retail Sub Type Bank Investment Type Net Lease Lease Type NNN Tenant Credit Credit Rated Tenancy Single

Lease Term 15 years Lease Commencement 11/30/2019 Rent Commencement 11/30/2019 Lease Expiration 11/29/2034 Remaining Term 15 years

Square Footage 3,500 Price/Sq Ft $1,750 Cap Rate 4.49% Occupancy Date 11/30/2019 NOI $275,000 Year Renovated 2019 Parking (spaces) 45

Rent Bumps 10% every 5 years Lease Options Four 5-year options Courtesy of CBRE

Chase Bank is strategically located with excellent access and visibility at the intersection of University Boulevard/MD 193 and East Avenue (Traffic Count: 30,762 VPD), just steps away from Veirs Mill Road/MD 586 (Traffic Count: 24,322 VPD). Veirs Mill Road flows into Georgia Avenue (Traffic Count: 40,513), a major north-south artery connecting Montgomery County to Washington, D.C. Georgia Avenue also connects the surrounding communities to the Capital Beltway (Traffic Count: 240,512 VPD).

The site is located in proximity to a critical mass of retail and destination shopping. Located directly across University Boulevard is the 1.65 MSF Westfield Wheaton Mall featuring retail and dining. The retail center boasts national tenants including Costco, JCPenney, Macy’s, Target, AMC Theatres, and Dick Sporting Goods. Situated along the ring road of the mall are Westfield Wheaton North and South. These two office buildings are home to a number of medical and professional services firms including MedStar Health, State Farm, AAA, Montgomery Community College, the Comptroller of Maryland, and the Maryland Department of Veteran’s Affairs, as well as numerous law firms and doctor’s offices.

BB&T 6.50% CAP | 1,920 SF | NOTTINGHAM, MD

Asking Price: $3,183,000

Property Type Retail Lease Type Absolute NNN

Tenant Credit Corporate Guarantee Tenancy Single

Lease Term 10 years Lease Commencement 04/01/2016

Lease Expiration 03/31/2026 Remaining Term 6.3 years

Square Footage1,920 Price/Sq Ft $1,657.81 Cap Rate 6.50%

NOI $206,877 Year Built 1955 Lot Size (acres)0.42

Courtesy of Sands Investment Group & Cushman Wakefiled

PNC Bank 5.70% CAP | 6,018 SF | BALTIMORE, MD

Asking Price: $2,315,700

Property Type Retail Investment Type Net Lease Lease Type NNN

Tenancy Single Square Footage 6,018 Price/Sq Ft $384.80

Cap Rate 5.70% Occupancy 100% NOI $132,000 Units 1 Year Built 1999

Year Renovated 2008 Buildings 1 Lot Size (acres) 0.1

Building located in northeast Baltimore. The location is a walking distance to John Hopkins University. Safeway Supermarket is directly across the street. CVS is only a few steps away. Courtesy of Bennett Williams

SunTrust Bank 6.42% CAP | 3,363 SF | PLANTATION, FL

Asking Price: $10,600,000

Property Type Retail Lease Type Absolute NNN Square Footage 3,363 Cap Rate 6.42% NOI $680,665 Year Built 1995

Zoning B-2L : Limited Community Business Lot Size (acres)1 Parking (per 1,000 sq ft) 5.04 APN 49-40-36-48-0030 Ownership Fee Simple

SRS National Net Lease Group is pleased to present the opportunity to acquire the fee simple interest (land & building) in a single tenant, absolute NNN leased SunTrust Bank investment property located in Plantation, FL. According to the FDIC, Suntrust, an S&P BBB+ investment grade tenant, is in the top 5 financial institutions (47 total) within the surrounding county. This location has above average Deposits of $34.5MM in 2017, a 13.3% increase from 2016. The tenant, Suntrust (S&P Investment Grade BBB+), has approximately 6 years remaining on their initial term and 4 (5-year) options to extend. The lease features annual 3% rental increases throughout the initial term, and is absolute NNN with zero landlord responsibilities.

The subject site is located at the signalized, hard corner intersection of W. Sunrise Boulevard/Florida State Road 838 and N. Flamingo Road (combined 70,132 VPD). The bank is a pad to an ALDI, hhgregg, and Michaels anchored shopping center with multiple points of ingress/egress and excellent visibility for a corner site. SunTrust Bank is uniquely positioned outside the perimeter of Sawgrass Mills Mall with nearly 2.4M SF of retail space making it the 8th largest mall in the U.S. and the second largest in mall in Florida. The mall has 10 anchor tenants that include Super Target, Saks Fifth, Neiman Marcus, Burlington, Century 21, Marshalls, Forever 21, Bed Bath & Beyond, BrandsMart USA, TJ Maxx, and Regal Cinemas. The bank serves approximately 233,000 residents with an average household income of $79,000 located within a 5-mile radius.

BB&T Bank 7.50% CAP 2,882 SF PORT ORANGE, FL

Asking Price: $1,421,787

Investment Type Net Lease Lease Type Absolute NNN

Tenant Credit Credit Rated Tenancy Single

Lease Expiration 12/30/2024 Remaining Term 5.1 years

Square Footage 2,882 Price/Sq Ft $493.33 Cap Rate 7.50%

NOI$106,634 Average Rent/Sq Ft$37 Year Built2003

Rent Bumps10% every five years Lease Options(2) 5-year options

TD Bank: Deerfield Beach, FL 5.65% CAP | 6,330 SF DEERFIELD BEACH, FL

Asking Price: $9,995,000

Lease Type Absolute NNN Tenant Credit Credit Rated Tenancy Single

Lease Expiration 11/30/2025 Remaining Term 6 years Sq Ft 6,330 Price/Sq Ft $1,578.99 Cap Rate 5.65% Occupancy 100% NOI $564,480 Year Built 1986 Stories 1 Lot Size (acres) 0.72 Parking (spaces) 20 Lease Options 4 x 5-Year Options Ownership Fee Simple By:CBRE

Chase Bank 5.15% CAP | 13 YEARS | OCALA, FL

Asking Price: $3,438,800

Property Type Retail Investment Type Net Lease Lease Type Absolute NNN Tenant Credit Credit Rated Tenancy Single

Rent Commencement 05/12/2012 Lease Expiration 05/09/2032 Remaining Term 12.4 years Square Footage 4,279 Price/Sq Ft $803.65

Cap Rate 5.15% NOI$177,100 Lot Size (acres)0.9 Rent Bumps 10% every 5 years Lease Options(4) 5-Year Options Ownership Fee Simple

We're pleased to present this long term absolute NNN fee simple ground lease with JP Morgan Chase. JP Morgan Chase is the largest bank in the United States and boasts an S&P rating of A+ with a stable outlook. There are 13 years remaining on a new 20 year lease with fixed rental increases of 10% every 5 years including options. There are no landlord management obligations or expenses. The property is at the signalized intersection and out parcel to the 87K SF Shoppes at Paddock Park and located directly on the primary east/west arterial in Ocala. This location is the retail “hub” in the Ocala market with 490K SF Paddock Mall directly adjacent to the site and most national retailers in the immediate vicinity. Courtesy of CBRE

Offereing Memorandum Downloads

Copyright © 2019 LeeRG.com by Lee Group LLC - All Rights Reserved

- About Us

- Services

- Manhattan NYC

- Brooklyn NY

- Miami FL

- International

- Manhattan NYC

- Brooklyn, NY

- Australia

- Canada

- Dubai

- London & Europe

- South Korea

- By Developers

- Luxury Rentals

- Manhattan NYC

- Ritz-Carlton Residences

- Four Seasons Residences

- Mandarin Oriental & Shang

- St.Regis Residences & Etc

- Viceroy Residences

- Bvlgari & W Residences

- Branded Residences

- New York New Homes

- New Jersey New Homes

- Connecticut New Homes

- California New Homes

- Florida New Homes

- Canada New Homes

- Exclusive Listings

- Offices

- Development Site

- Hotels & Hospitality

- Golf Courses & Resorts

- Triple Net Banks For Sale

- Triple Net Pharmacy

- Triple Net Retails

- Triple Net Restaurants

- Triple Net Starbucks

- Blog, News & Media

- Buyer's & Renter's Guide

- Neighborhoods

- Opportunity Zone

- Cruise,Yacht,Limo Service

- Luxury Shopping Services

- Private Jet Services

- Contact Us

Powered by Lee Group LLC