We're selling Triple-Net-Pharmacy Nationwide

Triple Net Walgreens For Sale Nationwide

WALGREENS ABS NET LEASE 6.20% CAP 14,805 SF IRONDEQUOIT, NY

Asking Price:$6,338,710

2100 E Ridge Road, Irondequoit, NY 14622 Property Type: Retail Remaining Term 61.4 years

Rent Commencement 03/01/2006 Lease Expiration 02/28/2081 Square Footage14,805 Price/Sq Ft $428.15

Cap Rate 6.20% NOI $393,000 Year Built 2006 Lot Size (acres)1.439 Courtesy of Marcus & Millichap

Walgreens - 6.03% CAP CHESTERTOWN,New York

Asking Price: $2,130,000

6272 U.S. 9, Chestertown, NY 12817

Property Type Retail Investment Type Net Lease

Lease Type NNN Tenancy Single

Lease Expiration 08/31/2031 Remaining Term 11.8 years

Cap Rate 6.03% NOI $128,496 Courtesy of Silber Properties

Walgreens 6.25% CAP 11,926 SF OSWEGO, NY

Asking Price:$10,558,528

Property Type Retail Lease Type Absolute NNN

Tenant Credit Credit Rated Tenancy Single

Square Footage 11,926 Price/Sq Ft $885.34

Cap Rate 6.25% NOI $659,908 Lease Options (3) 5 Year Options

Courtesy of Legacy Real Estate Advisors

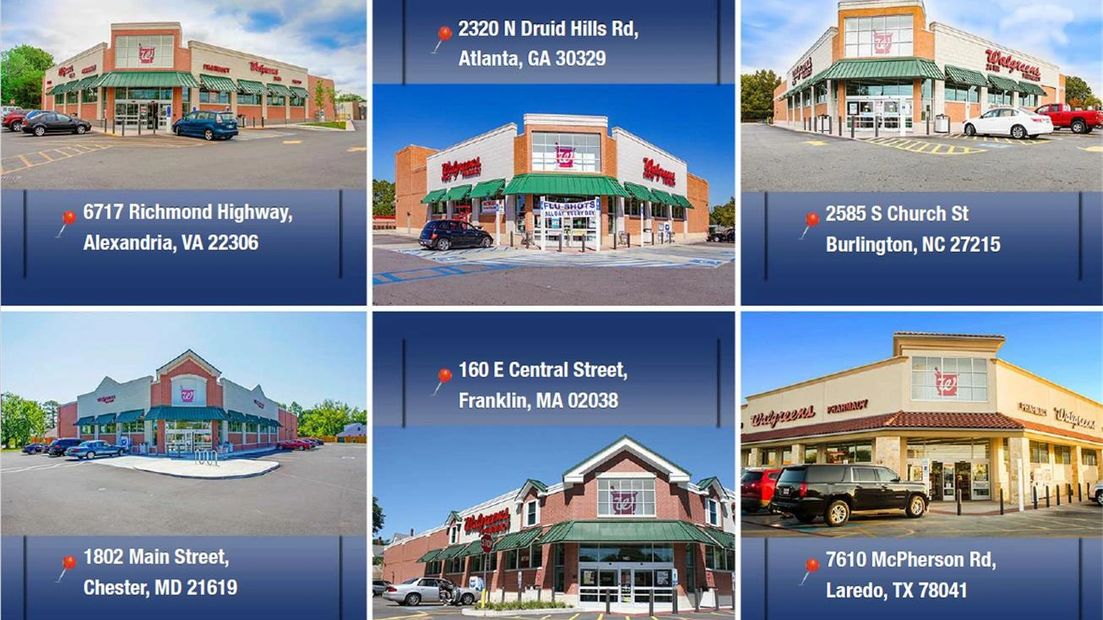

For sale this Walgreens portfolio of six strong performing stores

Located in Virginia, Georgia, North Carolina, Maryland, Massachussets and Texas.

Walgreens (NYSE: WBA) is a publicly traded company with an S&P Credit Rating of BBB and is ranked #17 in the Fortune 500 (2019). Some financial highlights include 2018 Revenues of $131.537 billion and 2018 Net Profits of $5.024 billion. Walgreen Co. operates over 8,200 stores in all 50 states, the District of Columbia, Puerto Rico and Guam. The company also operates worksite health centers, home care facilities, and specialty and mail service pharmacies.This is an opportunity for an investor to acquire six long term fee-simple Absolute NNN leases Walgreens with zero landlord responsibilies.

7610 McPherson Rd, Laredo, TX 78041 & 6717 Richmond Hwy, Alexandria, VA 22306

2320 N Druid Hills Rd NE, Atlanta, GA 30329 & 2585 S Church St, Burlington, NC 27215

1802 Main St, Chester, MD 21619 & 160 E Central St, Franklin, MA 02038 Courtesy of Marcus & Millichap

Walgreens - Utica 6.06% CAP 14,820 SF NEW YORK MILLS, NY

Asking Price: $5,450,000

Property Type Retail Investment Type

Net Lease Absolute NNN

Tenant Credit Corporate Guarantee Tenancy Single

Lease Expiration 03/31/2032 Remaining Term 12.3 years

Square Footage14,820 Price/Sq Ft $367.75

Cap Rate 6.06% NOI $330,000 Year Built 2007

Lease Options 10, 5-year by JLL

Walgreens 15 Year NNN Lease 6.25% CAP 13,813 SF HORNELL, NY

Asking Price: $5,398,064 Property Type Retail Lease Type NNN

Tenant Credit Credit Rated, Corporate Guarantee Tenancy Single Lease Term 20 years Lease 02/24/2005 to 02/02/2025

Expiration 03/31/2034 Remaining Term 14.3 years

Square Footage 13,813 Price/Sq Ft $390.80

Cap Rate 6.25% NOI $337,379 Lot Size (acres) 1.71

Rent Bumps No Lease Options 4 - Five Year Options

Ownership Fee Simple by Marcus & Millichap

Walgreens 15 Year NNN Lease 6.25% CAP 13,813 SF BARNEVELD, NY

Asking Price:$4,870,896

Property Type Retail Lease Type NNN Tenant Credit Corporate Guarantee

Lease Term 20 years Lease Commencement 07/20/2005 Lease Expiration 03/30/2034 Remaining Term 14.3 years

Square Footage 13,813 Price/Sq Ft $352.63 Cap Rate 6.25% NOI $304,431

Year Built 2003 Lot Size (acres) 2.5 Rent Bumps No Lease Options 4- Five Year Options Ownership Fee Simple

We're pleased to present for sale this Net Leased Rite Aid (now backed by Walgreens as of February 2018) located at 8052 State Route 12, Barneveld, New York in Oneida County, less than an hour drive due East from Syracuse, New York and an hour and a half North West of Albany, New York. There is no direct Walgreen’s competition in the area; the closest Walgreen’s is 15 miles away in Utica, New York. Courtesy of Marcus & Millichap

Walgreens 6.75% CAP 12,696 SF SCHENECTADY, NY

Asking Price:$3,828,266

Property Type Retail Investment Type Net Lease

Lease Type NNN Tenant Credit Corporate Guarantee

Tenancy Single Lease Term 5 years

Lease Commencement 05/31/2019 Lease Expiration 05/31/2024

Remaining Term 4.5 years Square Footage 12,696 Price/Sq Ft $301.53

Cap Rate 6.75% NOI $258,408 Year Built 1997 Lot Size (acres) 0.95

Ownership Fee Simple

Courtesy of Marcus and Millichap

WALGREENS W/ RARE RENTAL INCREASES 7.00% CAP 14,490 SF WATERTOWN, NY

Asking Price: $5,800,000

Property Type Retail Sub Type Drugstore Investment Type Net Lease

Investment Sub Type Drugstore Lease Type Absolute NNN

Tenant Credit Corporate Guarantee, Credit Rated Tenancy Single Lease Term 75 years Rent 07/30/2006 to 07/30/2081

Remaining Term 61.7 years Square Footage 14,490 Price/Sq Ft $400.28

Cap Rate 7.00% NOI $406,000 Year Built 2006 Lot Size (acres) 1.53 Courtesy of Marcus & Millichap

Walgreen's near Boston MA Rent Increases 5.75% CAP 14,820 SF BRIDGEWATER, MA

Asking Price: $12,245,000

Property Type Retail Lease Type Absolute NNN Tenancy Single Lease Term 75.1 years

Lease Commencement 09/22/2008 Lease Expiration 09/30/2083 Remaining Term 63.9 years

Square Footage 14,820 Price/Sq Ft $826.25 Cap Rate 5.75% NOI $704,000 Year Built 2008 Lease Options 10 x 5-Years

For Sale The 14,820 Sf Walgreens Located At The Nec Broad Street & Summer Street, Bridgewater, Ma. This Opportunity Includes An Investment-grade Tenant With An Absolute Triple Net Lease With Fixed Built-in Rental Increases, Located In An Area With Minimal Competition,

Providing For A Secure Investment. Courtesy of Nai Capital, Inc.

Walgreens 6.00% CAP 15,120 SF FAIRHAVEN, MA

Remaining Term 12.9 years Net Rentable (sq ft) 15,120

Price/Sq Ft $362.10 Cap Rate 6.00% Occupancy 100%

NOI $328,500 Year Built 2002 Buildings 1

Lot Size (acres) 1.7 Rent Bumps No

7, 5-Year Options Ownership Fee Simple

Courtesy of Horvath & Tremblay

Price Reduction - Walgreens 6.00% CAP 14,820 SF SPRINGFIELD, MA

Investment Type Net Lease Lease Type NNN

Tenancy Single Lease Expiration 12/30/2031

Remaining Term 12.1 years Square Footage 14,820

Price/Sq Ft $411.02 Cap Rate 6.00% NOI $365,475 Year Built 2006

Buildings 1 Stories 1 Lot Size (acres) 1.82 Ownership Fee Simple

Walgreens 8.00% CAP | 14,000 SF | JACKSONVILLE, FL

Asking Price: $1,802,500

Property Type Retail Investment Type Net Lease Lease Type NN Tenancy Single Lease Term 25 years

Lease Commencement 11/18/1996 Lease Expiration 11/30/2021 Remaining Term 2 years Square Footage 14,000Price/Sq Ft $128.75

Cap Rate 8.00% NOI $144,200Year Built 1996 Buildings 1 Stories 1 Lot Size (acres) 1.45 Lease Options 4, 5-Year Ownership Fee Simple

- Walgreens in Jacksonville, FL | The Largest City in Florida | Income Tax Free State

- More Than Two Years Remaining on a Double Net (NN) Lease | Tenant Extended the Lease in 2016

- Corporate Guaranty | NASDAQ: WBA | #17 in Fortune 500 (2019)

- Capital Improvements | Roof was Replaced in 2017 | 20 Year Warranty

- Signalized Hard Corner Location | More Than 20,000 Vehicles Per Day (VPD)

- Strong and Growing Demographics | More Than 195,000 Residents Within 5 Miles | 15 Percent Growth from 2010

- Out Lot to a Publix Anchored Shopping Center | More Than 700,000 Square Feet of Retail

- Additional Tenants in the Immediate Vicinity Include: McDonald’s, Wendy’s, Hardee’s, and Many More. Courtesy of SAB CAPITAL LLC

PRICE REDUCTION - Walgreens 6.00% CAP 14,820 SF SPRINGFIELD, MA

Asking Price: $6,091,250 Property Type Retail Investment Type Net Lease Lease Type NNN Tenancy Single Lease Expiration 12/30/2031 Remaining 12.1 years Sq Ft 14,820 Price/Sq Ft $411.02 Cap Rate 6.00%

NOI $365,475 Year Built 2006 Buildings 1 Stories 1

Lot Size (acres) 1.82 Ownership Fee Simple Courtesy of SAB CAPITAL

Walgreens | New 15 Yr Abs. NNN 15 YEAR NNN Strong Store Sales History SCHERERVILLE, IN

Asking Price: $6,415,094

Property Type Retail Investment Type Net Lease

Lease Type NNN Rent 10/25/2019 to 10/25/2034

Remaining Term 14.9 years Square Footage 15,120 Price/Sq Ft $424.28

Cap Rate 5.30% NOI $340,000 Courtesy of SAB Group

Walgreens + Keller Williams 6.50% CAP | 19,111 SF | PT PLEAS BCH, NJ

Asking Price: $6,775,000

Property Type Retail Investment Type Net Lease Lease Type NNN Tenant Credit Corporate Guarantee Tenancy Multi Number of Tenants 2

Square Footage 19,111 Price/Sq Ft $354.51 Cap Rate 6.50% Occupancy 100% NOI $440,090 Units 2 Year Built 2009 Buildings 1 Stories 1

Lot Size (acres) 2.92 Parking (spaces) 72 Ownership Fee Simple Courtesy of Marcus Millichap

- 2 Tenant Retail Center 19,111 SF – Located at 1513 Richmond Ave, Point Pleasant, Ocean County, New Jersey

- Walgreens Corporate Guarantee – Operating at This Location for Over 10 Years – Includes Drive Thru

- Walgreens - NNN Lease with 10% Increases Every 10 Years

- Keller Williams Realty Ocean Living – Brand New Fit Outs in 2017 – Approx. 150 Agents at This Keller Williams Office

115 Morris Avenue 13,369 SF SPRINGFIELD TOWNSHIP, NJ

Asking Price: $11,500,000

Property Type Retail Sub Type NNN Lease

Investment Type Net Lease Lease Type Absolute NNN

Tenant Credit Corporate Guarantee Tenancy Single

Square Footage 13,369 Price/Sq Ft $860.20

Year Built 2013 Buildings 1 Stories 1 by GFI Realty Services LLC

Walgreens Vineland 5.75% CAP 14,000 SF VINELAND, NJ

Asking Price: $9,043,479

Investment Type Net Lease Lease Type Absolute NNN

Tenancy Single Lease Term 25.1 years Lease 10/06/2008-10/31/2033 Remaining Term 13.9 years Square Footage 14,000 Price/Sq Ft $645.96 Cap Rate 5.75% NOI $520,000 Units 1 Year Built 2007 Lot Size 2.68 AC

Lease Options(10) 5-Year Options By Landmark Real Estate

Walgreens 6.85% CAP | 14,820 SF | KILMARNOCK, VA

Asking Price: $5,110,000

Property Type Retail Sub Type DrugstoreInvestment Type Net LeaseClass A Lease Type Absolute NNN Tenant Credit Rated, Corporate Guarantee

Tenancy Single Rent Commencement 03/15/2008 Lease Expiration 03/29/2033 Remaining Term 13.3 years Net Rentable (sq ft) 14,820

Price/Sq Ft $344.80 Cap Rate 6.85% Occupancy 100% Occupancy Date 03/15/2008 NOI $350,000 Units 1 Year Built 2008 Buildings 1 Stories 1

Lot Size (acres) 2.7 Rent Bumps No Lease Options 50 - 1 Year Options Ground Lease No Ownership Fee Simple Courtesy of RDO Investments

is pleased to present a fee simple, single tenant, 14,820 square foot Walgreens in Kilmarnock, Virginia. The property is strategically located in the main retail thoroughfare of North Main Street in Kilmarnock, Virginia. The property was constructed in 2008 and has excellent visibility and good ingress and egress. The tenant signed an original 25 year lease in 2008 and fifty, one year options. The lease is pure NNN, with no Landlord Responsibilities whatsoever.The property can be purchased as a portfolio sale or on a one off basis.

Walgreens 7.00% CAP | 13,865 SF | RICHMOND, VA

Asking Price : $2,880,323

Property Type Retail Sub Type Pharmacy

Investment Type Net Lease Lease Type NN+

Corporate Guarantee Tenancy Single Lease Term 31 years

Lease 08/29/1996 - 08/29/1996 Expiration 08/29/2027

Remaining Term 7.7 years Square Footage13,865

Price/Sq Ft $207.74 Cap Rate 7.00% Occupancy 100%

NOI $201,624Units1 Year Built 1996 Buildings 1

Lot Size (acres)1.83 Lease Options(5) 5-Year Options

Ground Lease No Ownership Fee Simple Retail Investment Group

Walgreens 6.75% CAP | 14,564 SF CASTLETON-ON-HUDSON, NY

Asking Price: $6,106,089

Property Type Retail Investment Type Net Lease

Lease Type NN Tenancy Single

Lease Expiration03/31/2027

Remaining Term7.3 years

Square Footage14,564 Price/Sq Ft $419.26

Cap Rate 6.75% NOI $412,161

Units1 Year Built 2000

The Boulder Group Lee & Associates

TROPHY WALGREENS WITH 14-Yrs& 5% Bumps 5.25% CAP | 14,820 SF | WESTBROOK, CT

Asking Price: $8,694,400

Property Type Retail Sub Type Drugstore Investment Type Net Lease Class A Lease Type Absolute NNN Tenant Credit Corporate Guarantee

Tenancy Single Lease Commencement 01/01/2007 Rent Commencement 03/31/2033 Net Rentable (sq ft) 14,820 Price/Sq Ft $586.67

Cap Rate 5.25% Occupancy 100% Occupancy Date 01/01/2007 NOI $456,456 Year Built 2007 Buildings 1 Stories 1 Zoning C Lot Size (acres) 1.57

Rent Bumps 5% Every 5 Years Lease Options Yes, 10, 5-Year Options Ground Lease No Ownership Fee Simple Courtesy of Marcus & Millichap

For sale the 100% fee simple interest in the single-tenant Walgreens retail property located at 1211 Boston Post Road, Westbrook, Connecticut 06498 (the “Property”). Build-to-suit for Walgreens in 2007, the Property comprises a +/- 14,820 SF building on an active +/- 1.57-acre parcel, that is strategically positioned along Boston Post Road/Route 1 with nearly 12,000 vehicles per day. Subject located in Westbrook, CT is situated only blocks from the Shore Line East Commuter Rail Service Station, only 50 miles from the State Capitol, Hartford, 75 miles from Providence, RI, 100 miles from NYC, and 120 miles from Boston, MA . The Property benefits from its location, smack dab in the center of Westbrook, an area with above average household income of over $113,000 within 5 miles of the subject and about 12,000 households in the same area.Walgreens Boots Alliance is an investment grade tenant, rated “B1” by Creditntell.com, and traded on the NASDAQ under the ticker “WBA”. Walgreens is the first global pharmacy-led, health and wellbeing enterprise of it’s kind. The Company’s heritage of trusted health care services through community pharmacy care and pharmaceutical wholesaling dates back more than 100 years. It is the largest retail pharmacy chain in the U.S. and one of the world’s largest purchasers of prescription drugs, along with numerous health, beauty, and wellbeing products. Nearly 8 million customers interact with Walgreens in stores and online each day.

Walgreens & Chase 9.50% CAP 20,040 SF BRIDGEPORT, CT

Asking Price: $4,542,201

Property Type Retail, Office Lease Type Absolute NNNTenancy Multi

Square Footage 20,040 Price/Sq Ft $226.66 Cap Rate 9.50%

NOI $431,509 Year Built 2004 Lot Size (acres) 1.73

Courtesy of James Capital Advisors

WALGREENS W/ Rare Rental Increase 7.00% CAP 14,820SF Butler (Greater PITTSBURGH REGION), PA

Asking Price: $6,579,714

Property Type Retail Investment Type Net Lease Absolute NNN

Tenant Credit Corporate Guarantee Tenancy Single SF14,820

Price/Sq Ft $443.98 Cap Rate 7.00%

NOI $460,580 Year Built 2008 Lot Size (acres) 2.32 by Marcus Millichap

Walgreens 6.25% CAP | 13,650 SF | EAST NORRITON, PA

Asking Price: $7,280,000

Property Type Retail Lease Type Absolute NNN Tenant Credit Corporate Guarantee Tenancy Single

Lease Term 75 years Lease Commencement 08/01/2004 Lease Expiration 07/31/2079 Remaining Term 59.7 years

Square Footage 13,650 Price/Sq Ft $533.33 Cap Rate 6.25% Year Built 2006 Lot Size (acres) 2.09 Ownership Fee Simple

- Long Term Lease with 5-year Option Structure * Medical Spending * Strong Demographics

- Philadelphia MSA * Nearby Retail Synergy * Prototype Store Format on Signalized Intersection

- Nationally Recognized Investment Grade Tenant Courtesy of Matthews

Walgreens 5.50% CAP 14,640 SF CANONSBURG, PA

Asking Price: $9,836,364

Property Type Retail Investment Type Net LeaseLease Type NNN

Lease Term 76 years Lease Commencement 01/01/2010

Lease Expiration 12/31/2085 Remaining Term 66.1 years

Square Footage 14,640 Price/Sq Ft $671.88 Cap Rate 5.50%

NOI $541,000 Lot Size (acres)1.4 Rent Bumps1.75% Increases

Every Five Years Beginning Year 26 Marcus Millichap

11635 East 13 Mile Road Warren, MI 48093 $4,676,906 Absolute Net Lease 7.5 Years 7.50% CAP

* Stable Income from Walgreens Corporate, a Top 20 Fortune 500 Co.

* Absolute Net Lease with No Landlord Responsibilities Whatsoever

* Detroit MSA Location - * Busy Intersection with ±30,000 VPD

* Average HH Income of $90,846 & Population of 204,235 in a 5-mi Radius * Major Medical Facilities Nearby - By Pharma Property Group

Opportunity Zone : Walgreens 7.50% CAP | 14,288 SF | DALLAS, TX

Asking Price:$2,224,000

Property Type Retail Lease Type Net Tenancy Single Lease Term 5 years Lease Commencement 10/31/2018 Lease Expiration10/31/2023

Remaining Term3.9 years Square Footage14,288 Price/Sq Ft$155.66 Cap Rate7.50% NOI $166,860 Year Built 1998 Lot Size (acres)2.88

Lease Options Eight, 5-year Options Ownership Fee Simple - Courtesy of The Kase Group

The subject property is a net leased Walgreens in Dallas, Texas. The lease calls for minimal landlord obligations. The twenty year lease ended in 2018, and the tenant is now exercising their first of eight 5-year renewal options beyond the initial term. The property is well-situated on a major retail corridor surrounded by natioanl retailers including 7-Eleven, Wendy’s and BB&T Bank.

Walgreens 6.25% CAP | 15,047 SF | DALLAS, TX

Asking Price: $5,375,000

Property Type Retail Lease Type Absolute NNN

Tenant Credit Corporate Guarantee Tenancy Single

Lease Term 25.1 years Lease 07/01/2002 - 07/31/2027

Remaining Term 7.6 years Square Footage 15,047 Price/Sq Ft$357.21

Cap Rate 6.25% NOI $335,949 Year Built 2000 Lot Size (acres)1.66

Lease Options Ten, 5-Year Options Ownership Fee Simple:Matthews

Walgreens 6.25% CAP | 14,560 SF | DALLAS, TX

Asking Price: $5,454,400

Property Type Retail Lease Type Absolute NNN Tenant Credit Corporate Guarantee Tenancy Single Lease Term 25 years

Lease Commencement 04/01/2004 Lease Expiration 03/31/2029 Remaining Term 9.3 years Square Footage 14,560 Price/Sq Ft $374.62

Cap Rate 6.25% NOI $340,900 Year Built 2004 Stories 1 Lot Size 1.74 Ten (10) Five (5) Year Options Ownership Fee Simple By Matthews

Walgreens OM Downloads

We're Selling CVS Nationwide ( East Coast)

CVS Pharmacy 5.60% CAP | 10,125 SF | DUNKIRK, NY

Asking Price: $3,764,285

Property Type Retail Lease Type NN Tenant Credit Credit Rated Tenancy Single Lease Expiration 01/31/2039 Remaining Term 19.2 years

Square Footage 10,125 Price/Sq Ft $371.78 Cap Rate 5.60% NOI $210,800 Units 1

For sale a single tenant net leased CVS Pharmacy located in Dunkirk, New York. CVS Pharmacy has successfully operated at this location since 2000 and CVS extended their lease in 2013 showing their commitment to the location. CVS has a long term lease with more than twenty years remaining. The CVS Pharmacy property features a drive-thru and has excellent visibility along Main Street. CVS Pharmacy is an investment grade rated company (S&P: BBB+) and publicly traded on the New York Stock Exchange using symbol “CVS”. The 10,125 square foot building is well located at the corner of a signalized intersection. Retailers in the immediate area include Save-A-Lot, Walgreens, KeyBank and Tim Hortons. The property is also located within close proximity to multiple residential communities, local businesses and schools including Dunkirk Middle School and Dunkirk High School (600+ students). The Walgreens property is located immediately off Interstate 90 and near Brooks Memorial Hospital.

CVS Pharmacy has over twenty years remaining on their lease which expires January 31, 2039 and features four 5-year renewal option periods and one 4-year with 5% rental escalations in each option. CVS Pharmacy is the nation's drugstore chain and total prescription revenue and operates 9,800+ locations in 49 states, the District of Columbia, Puerto Rico and Brazil. Courtesy of The Boulder Group

CVS Pharmacy | Recent 10 Yr Extension | College Town Location | Smaller Price Point | 6.5% $3,004,430

PROPERTY ADDRESS : 13 PORT WATSON ST. CORTLAND, NY 13045

ESTABLISHED & SUCCESSFUL PHARMACY - CVS has been successfully operating here since 1998 and has extended its lease numerous times, most recently for another 10 years, showing a strong commitment to this location COLLEGE TOWN LOCATION

The State University of New York (SUNY) College at Cortland is located just 0.5 miles from CVS with over 6,800 students enrolled

INVESTMENT GRADE CREDIT - The lease is corporately guaranteed by CVS,an investment grade credit tenant, rated “BBB” by Standard & Poor's

SMALL PRICE POINT - At just over $3M this is a small price point for an investment grade pharmacy with lease term

DENSE INFILL SITE In-town, easily walkable location surrounded by numerous local businesses, restaurants and residential homes

EASILY ACCESSIBLE CVS is ideally located just 1 mile from the on/off ramps of I-81 with traffic counts over 22,000 vehicles per day

RENTAL INCREASES - There are 8% rental increases in each of the three, five year lease renewals remaining OM VIDEO

ALL BRICK CONSTRUCTION The property features all brick construction and offering low deferred maintenance. Courtesy of CBRE

345 Main St - CVS 10,125 SF Retail Building Offered at $3,247,820 at a 7.25% Cap Rate in Johnson City, NY

HIGHLIGHTS

- CVS has been successfully operating here since 1997 and has extended its lease numerous times, most recently for another 5 years

- Dense infill location directly across Main Street from UHS Medical Center, a 280 bed regional hospital

- CVS is located immediately of Interstate 86, the main East/West corridor across Southern NY with traffic counts exceeding 63,000 vehicles per day

- The lease is corporately guaranteed by CVS, an investment grade credit tenant, rated “BBB” by Standard & Poor's

* At just over $3.2M this is a small price point for an investment grade pharmacy offering a going in yield of 7.25%

* Excellent visibility along N Main Street, a major throughway in Johnson City with traffic counts of 12,500 vehicles per day

* Sale Conditions-Investment Triple Net Tenancy : Single Property Type Retail Parking Ratio 6.22/1,000 SF Property Sub-type Drug Store Zoning Description CBD B/D Class BAPN Lot Size1.26 AC.Courtesy of CBRE OM VIEW PROPERTY VIDEO

CVS Pharmacy - Queens, New York

CVS - 10% INCREASES- BRAND-NEW 25-YEAR LEASE

61-15 Metropolitan Avenue Ridgewood, NY 11385 VIDEO

Price: $ 19,699,347 Occupancy 100% Building Size13,482 SFNo. Stories 1 Property Type Retail Tenancy Single Property Sub-type Free Standing Bldg Year Built 2012 Property Use Type Net Lease Investment with 10+ years left on lease Lot Size1.38 AC Cap Rate 5.68% Courtesy of Marcus & Millichap

CVS 5.67% CAP | 12,487 SF | STATEN ISLAND, NY

Asking Price: $12,250,000

Property Type Retail Investment Type Net Lease Lease Type NNN

Tenant Credit Corporate Guarantee Tenancy Single

Term 25 years Lease 09/28/2013- 09/30/2038 Remaining 18.8 years

Square Footage 12,487 Price/Sq Ft $981.02 Cap Rate 5.67%

Occupancy Date 09/29/2013 NOI $694,300 Year Built 2013 Buildings 1

Stories 1 Zoning C2-2, R3A,SRD Lot Size (sq ft) 42,100

Parking (spaces)35 Lease Options 25 year lease W/4-5 year options with a 10% increase every 10 years Courtesy of Remax

CVS Pharmacy NNN •13 YEAR REMAINING• Close to Medical Centers Batavia,NY

Asking Price: $5,434,983

Sub Type Drug Store Investment Type Net Lease Type Absolute NNN

Tenant Credit Credit Rated, Corporate Guarantee Tenancy Single

Lease Expiration 01/31/2033 Remaining Term 13 years

Square Footage 11,945 Price/Sq Ft $455 Cap Rate 6.00%

Occupancy 100% NOI $326,099 Units 1 Year Built 2006 Building 1

Lot Size (acres) 1.4 Rent Bumps 5% Increase in each Option

Lease Options 6, 5-Year Ownership Fee Simple By Stan Johnson Co.

CVS/Pharmacy - 7.50% Blended Cap Rate 7.25% CAP | 7,011 SF | HYDE PARK, NY

CVS/Pharmacy located at 4170 Albany Post Road in Hyde Park, Dutchess County, New York, featuring rare annual rent increases to hedge against inflation and strategically located less than one-quarter mile north of the highly visited Franklin D. Roosevelt National Historic Site. The subject property consists of a single-story 7,011 square foot freestanding structure positioned on a one-acre lot with 48 parking spaces. This double net (NN) leased CVS/Pharmacy asset has just under four (4) years remaining on the lease base term (expiration January 2023) and features annual three (3) percent rent increases along with four, five year tenant options to extend. The lease is corporately guaranteed by CVS Health Corporation, the 7th largest company in the Fortune 500 index with an S&P credit rating of BBB and revenues of $194.6 billion for fiscal year 2018.

Details : Retail Lease Type NN Tenant Credit Corporate Guarantee Tenancy Single

Lease Expiration 01/31/2023 Remaining Term 3.3 years Square Footage 7,011 Price/Sq Ft $328.06 Cap Rate 7.25% NOI $166,860

Permitted Zoning Commercial/Retail Lot Size (acres)1 Parking (spaces) 48 APN 23-04-25-020392-008-04 Lease Options 4, 5-Year Option

Rent Schedule Lease Type Double Net (NN) TERM START/END DATE INCREASES BLENDED CAP Base Nov. 2014 - Nov. 2019 Flat - Base Nov. 2019 - Jan. 2023 3% Annual 7.50% Option 1 Feb. 2023 - Jan. 2028 3% Annual 8.67% Option 2 Feb. 2028 - Jan. 2033 3% Annual 10.05% Option 3 Feb. 2033 - Jan. 2038 3% Annual 11.65% Option 4 Feb. 2038 - Jan. 2043 3% Annual 13.51% Courtesy of Marcus & Millichap

CVS Pharmacy 7.00% CAP 13,635 SF GAITHERSBURG, MD

Asking Price: $3,985,000

Property Type Retail Lease Type Absolute NNN

Tenant Credit Credit Rated Tenancy Single Lease Term 24.9 years

Lease 03/31/2008 - 01/30/2033 Remaining Term13.2 years

Square Footage 13,635 Price/Sq Ft $292.26 Cap Rate 7.00%

Occupancy 100% NOI $278,907 Year Built 2008 Stories 1 Lot Size1.25

Courtesy of Colliers International

CVS Pharmacy NEW PRICING & TERMS NEWLY SIGNED 18 YEAR LEASE Hagerstown, MD 21740

Asking Price: $3,735,927

Property Type Retail Sub Type Drug Store Net Lease

Lease Type NNtCredit Rated, Corporate Guarantee Tenancy Single

Lease Term 18 years Lease 12/31/2017 - 01/30/2036

Remaining 16.2 years Square Footage 10,800 Price/Sq Ft $345.92

Cap Rate 5.50% Occupancy 100% NOI $205,476 Year Built 2001

Lot Size (acres) 1.08 Rent Bumps 6% in Option Periods

Lease Options 4x 5 Year Ownership Fee Simple By:Marcus Millichap

Brand New 25-Year CVS Portfolio 531,065 SF | RUSSELLVILLE, AR

Asking Price : Unpriced

Deal terms are not currently defined. Request your own specific terms when submitting a non-binding offer.

New to the market, Thomas Company is pleased to offer for sale a portfolio of 44 CVS stores, in 20 states, totaling +/- 531,065 square feet of retail space. Each of the properties has a brand new 25-year lease which commenced in October 2019. The properties are offered as highly leveraged zero-cash-flow investments, with attractively priced, assumable loans on each property that fully-amortize prior to the expiration of each lease. The properties provide an investor with significant passive losses to help offset unsheltered cash flow from other real estate and are available individually, in pools, or as a portfolio.

Property Type Retail Investment Type Net Lease Lease Type NNN Tenant Credit Corporate Guarantee Tenancy Single

Lease Commencement 10/17/2019 Rent Commencement 10/17/2019 Net Rentable (sq ft) 531,065 Occupancy 100%

NOI $15,416,124 Year Built 2019 Buildings 44 Stories 1 Rent Bumps No Lease Options 10

Brand New 25-Year Leases * 44 Properties in 20 States * Investment Grade Guarantee

Properties available individually, in pools, or as a portfolio Courtesy of Thomas Company

CVS Pharmacy Pleasant Grove, AL

13+ Years Remaining Price: $4,275,000

* Established Location - In Operation Since 2001

Lease is Corporately Guaranteed by CVS Health | S&P “BBB+” * Store Recently Approved for “Refresh Remodel” by CVS Five (5), Five-Year Option Periods with Rental Increases. * Prototypical Freestanding CVS Equipped with Drive-Thru *1-Mile Average Household Income: $65,533

108 Park Rd Pleasant Grove,AL 35127 CVS PHARMACY - BIRMINGHAM MSA VIMEO

Courtesy of Encore Real Estate Investment Services

Brand New 25-Year CVS Portfolio 531,065 SF RUSSELLVILLE, AR

Asking Price : Unpriced

Property Type Retail Investment Type Net Lease Lease Type NNN Tenant Credit Corporate Guarantee Tenancy Single

Lease Commencement 10/17/2019 Rent Commencement 10/17/2019

Net Rentable (sq ft) 531,065 Occupancy 100%

NOI $15,416,124 Year Built 2019 Buildings 44 Stories 1 Rent Bumps

No Lease Options 10 44 Properties in 20 States * Investment Grade Guarantee. Courtesy of Thomas Company

CVS I 20 Year NNN | Richmond MSA 5.15% CAP | 10,107 SF | MECHANICSVILLE, VA

Asking Price: $4,038,835

Property Type Retail Investment Type Net Lease Lease Type Absolute NNN Tenant Credit Credit Rated Tenancy Single

Lease Term 20 years Lease Commencement 10/01/2019 Lease Expiration 10/01/2039 Remaining Term 19.8 years Square Footage10,107

Price/Sq F t$399.61 Cap Rate 5.15% Occupancy Date 08/01/2000 NOI $208,000 Year Built 2000 Lot Size (acres) 1.36

Rent Bumps 7% in Options Lease Options 10-5 Year Ground Lease No Ownership Fee Simple

Dallas Net Lease is please to present the opportunity to acquire a strong performing CVS located in the city of Mechanicsville, VA, an affluent suburb of Virginia. It sits at the intersection of Charter Gate Drive and Atlee Station Road, about 7 miles north of Richmond and a mile south of the Hanover Airport. The property is next to the Kings Charter development which is an established, sought after residential community with over 900 single family homes. CVS signed a new 20-year lease showing its strong commitment to the site. Following the initial term there are 10-5-year option periods that have 7% increases in each. It is in a strong retail trade area being located next to Food Lion, McDonalds, BB&T, Walmart Neighborhood Market, The Home Depot, Sheetz and many more. The interest being sold is Fee-Simple and the property will be delivered free and clear of debt. CVS is responsible for all maintenance and repairs, leaving the Landlord with zero responsibilities.

CVS - UNIV. OF GEORGIA - NEAR HOSPITALS 5.35% CAP | 14,781 SF | Athens, GA $8,470,000

Retail Sub Type NNN Investment Type Net Lease

Class A Lease Type Absolute NNN Tenant Credit Credit Rated

Tenancy Single Lease Expiration 01/31/2035 Remaining Term 15.3 years

Square Footage 14,781 Price/Sq Ft $573.03

Cap Rate 5.35% NOI $453,127 Units 1 Year Built 2009

Stories 1 Lot Size (acres) 2.47 Parking (spaces) 63

Lease Options10, 5-Year Options Ownership Fee Simple

795 Oglethorpe Ave, Athens, GA 30606 Courtesy of Marcus & Millichap

CVS/Pharmacy - Limited Competition 5.64% CAP 11,945 SF DANVILLE, VA

Property Type Retail Sub Type NNN Investment Type Net Lease

Class A Lease Absolute NNN Corporate Guarantee Tenancy Single

Lease Expiration 01/31/2034 Remaining Term 14.3 years

Square Footage 11,945 Net Rentable (sq ft) 11,945

Price/Sq Ft $447.89 Cap Rate 5.64% NOI $301,789

Year Built 2008 Stories 1 Lot Size (acres) 1.3 Parking (spaces) 69

Rent Bumps Yes Lease Options 10, 5-Year Options

Ownership Fee Simple Courtesy of Marcus & Millichap

CVS/Pharmacy 6.75% CAP | 8,000 SF | DANVILLE, VA

Asking Price: $3,729,140

Property Type Retail Lease Type Absolute NNN Tenant Credit Credit Rated Tenancy Single Lease Term 25.1 years

Lease Commencement 12/19/2007 Lease Expiration 01/30/2033 Remaining Term 13.2 years Square Footage 8,000 Price/Sq Ft $466.14

Cap Rate 6.75% Occupancy 100% NOI $251,717 Year Built 2007 Lot Size (acres) 3.71 Lease Options 2 (5) Year Options Ownership Fee Simple

This is a rare CVS/pharmacy absolute net leased offering in Danville, Virginia. The lease calls for zero landlord obligations with two 5 year options at 90% of prior rent, then eight 5 year options at FMV, along with a rent holiday for the last three years of the lease. The asset is well situated on a major commercial thoroughfare and is nearby PATHS Community Medical Center. Courtesy of The Kase Group

JUST LISTED Long-Term CVS Florida Tax Free State

5610 OVERSEAS HIGHWAY, STOCK ISLAND, FLORIDA

Ownership Type Fee Simple Price :$9,220,000 Cap Rate:4.70% Current Rent: $433,320 Lease: Triple Net Remaining Term:Approx. 20+ years

Renewal Options: Yes Building Sq. Ft.:14,600 Site Size:2.51

Courtesy of STREAM Capital Partners

CVS $5,191,567 | 6.00% CAP | West Palm Beach, FL

Property Type Retail Tenancy Single Net Lease Lease Absolute NNN

Lease Expiration 07/23/2027 Remaining Term 7.8 years

Square Footage 12,739 Price/Sq Ft $407.53

Cap Rate 6.00% NOI $311,494 Units 1 Year Built 2002

Lease Options Five 5 Year Courtesy of The Boulder Group

CVS Pharmacy 6.25% CAP | 14,110 SF | BALTIMORE, MD

Asking Price: $1,696,000

Property Type Retail Lease Type Net Tenant Credit Corporate Guarantee, Credit Rated Tenancy Single Lease Term 35 years

Lease Commencement 03/26/1995 Lease Expiration 03/31/2030 Remaining Term 10.3 years Square Footage 14,110 Price/Sq Ft $120.20

Cap Rate 6.25% Occupancy 100% NOI $106,000 Year Renovated 2004 Lot Size (acres) 0.48 Parking (spaces) 18 Three (3) Five (5) Year Options

This CVS offers a 10 year net lease, with a corporate guaranty.- Courtesy of Cushman Wakefield

With 29,102 vehicles per day directly in front of the property, and a central location in a large city, the store boasts strong sales and significantly below market rent. CVS has exercised an early extension for 11 years, demonstrating a long term commitment to the location.

This is a rare “hands-off” investment opportunity to purchase a long-term net leased pharmacy asset with proven success in the market.

CVS Pharmacy | Capview Exchange, LLC 5.50% CAP | 13,225 SF | POTTSVILLE, PA

Asking Price: $6,653,127

Property Type Retail Sub Type Pharmacy Investment Type Sale/Leaseback Lease Type NNN Tenancy Single Lease Term 20 years

Remaining Term 20 years Square Footage 13,225 Price/Sq Ft $503.07 Cap Rate 5.50% Occupancy 100% NOI $365,922

Year Built 2010 Lot Size (acres) 2.94 Lease Options Ten, 5 year

Colliers International is pleased to offer for sale to qualified investors the 100% fee simple interest in a true NNN CVS leased (sublease) pharmacy store located in Pottsville, PA.

This is an opportunity to acquire the dominant pharmacy in the market. CVS has operated at the site since 2010. The property sits at a lighted intersection with a specific address of 212 Pottsville street, Pottsville, PA, and contains 13,225 sf.

The Master Tenant and guarantor is Capview Exchange, LLC (CXL). CXL is the 12th net lease fund created by Capview Partners since 2010. CXL is providing a 20 year lease with zero Landlord responsibilities. For additional security, CXL will reserve approximately 1 year’s rent throughout the term of the lease. A detailed explanation of the deal structure follows in the financial section of this offering.

The 20 year lease is offered at $6,653,127 on which translates to a 5.50% cap rate. The lease contains 10 additional 5 year options to extend the lease.

CVS Pharmacy - Levittown, PA (PHI MSA) $5,352,380 5.25% CAP 18+ YEARS REMAINING LEASE TERM

Asking Price: $5,352,380

Property Type Retail Lease Type NN Tenancy Single

Rent Commencement 10/25/2000

Lease Expiration 12/30/2037 Remaining Term 18.1 years

Square Footage 10,125 Price/Sq Ft $528.63 Units 1

Cap Rate 5.25% NOI $281,000 Year Built 2000 Lot Size (acres)1.51

Rent Bumps 13.5% rental increase in the option period

Lease Options One (1) Five (5) Year Option Courtesy of JLL

CVS | NNN Lease 6.00% CAP | 10,125 SF | YEADON, DELAWARE COUNTY, PA

Asking Price: $2,666,666

Property Type Retail Lease Type NNN

Tenant Credit Credit Rated, Corporate Guarantee

Tenancy Single Lease Expiration 12/29/2029

Remaining Term 10.1 years Square Footage 10,125 Price/Sq Ft $263.37

Cap Rate 6.00% NOI $160,000 Year Built 2000

Rent Bumps In Options Lease Options Three, 5-Year Options

Ownership Fee Simple Courtesy of Equity Retail Brokers

CVS Offering Memorandum Downloads

Triple Net Rite Aid For Sale

Opportunity Zone Walgreens 6.45% CAP | 10,908 SF NORWICH, NY

Opportunity Zone Walgreens 6.45% CAP | 10,908 SF NORWICH, NY

Opportunity Zone Walgreens 6.45% CAP | 10,908 SF NORWICH, NY

82 N Broad St, Norwich, NY 13815

Asking Price: $3,652,915

Property Type Retail

Investment Type Net Lease Lease Type NN

Tenancy Single

Lease Expiration 12/07/2028

Remaining Term 9.2 years

Square Footage 10,90 Price/Sq Ft$334.88

Cap Rate 6.45% NOI $235,613 Units 1

Options Two 5-Year By The Boulder Group

1301 STATE ST DELMAR, MD 21875

Opportunity Zone Walgreens 6.45% CAP | 10,908 SF NORWICH, NY

Opportunity Zone Walgreens 6.45% CAP | 10,908 SF NORWICH, NY

PRICE: $6,153,375 CAP RATE: 8.00%

YEAR BUILT: 2005 LOT SIZE:1.749 Acres

BUILDING SQUARE FOOTAGE:14,564

TYPE OF OWNERSHIP:Fee Simple

LEASE GUARANTOR:Corporate Guarantee

LEASE TYPE: NNN LEASE TERM: 20 Years

ROOF AND STRUCTURE:Landlord Responsible RENT:5/26/2005 LEASE EXPIRATION:5/25/2026 REMAINING 7 Years

INCREASES:In the Options OPTIONS: 5x5 Years Courtesy of CBRE

Rite Aid 7.00% CAP | 12,738 SF CORTLANDVILLE, NY

Opportunity Zone Walgreens 6.45% CAP | 10,908 SF NORWICH, NY

1067 State Rte 222, Cortlandville, NY 13045

Asking Price: $3,282,786

Investment Type Net Lease

Lease Type NN

Tenancy Single

Lease Expiration 09/27/2028

Remaining Term 9 years

Square Footage 12,738 Price/Sq Ft $257.72

Cap Rate 7.00% NOI $229,79

By The Boulder Group and Lee & Associates

Walgreens 6.50% CAP 10,908 SF MATTYDALE, NY

Asking Price: $5,261,277

Property Type Retail Lease Type NN

Tenancy Single

Lease 04/27/2028 Remaining Term 8.4 years

Square Footage 10,908 Price/Sq Ft $482.33

Cap Rate 6.50% NOI $341,983 Units 1

Courtesy of The Boulder Group

Rite Aid 10 Year Net Leased 7.15% CAP 10,908 SF AMHERST, NY

Rite Aid 10 Year Net Leased 7.15% CAP 10,908 SF AMHERST, NY

Asking Price: $5,261,277

Property Type Retail Lease Type NN

Tenancy Single

Lease Expiration 04/27/2028

Remaining Term 8.4 years

Square Footage 10,908 Price/Sq Ft $482.33

Cap Rate 6.50% NOI $341,983

Units 1 Courtesy of

Pegasus Investments Real Estate Advisory Inc.

Walgreens 6.01% CAP 14,550 SF NEW HARTFORD, NY

Rite Aid 10 Year Net Leased 7.15% CAP 10,908 SF AMHERST, NY

Asking Price:$3,995,000

Property Type Retail Investment Net Lease

Lease Type NNN Tenancy Single

Lease Term 25 years Lease 07/01/2006 to 06/30/2031 Remaining Term 11.6 years

Square Footage 14,550 Price/Sq Ft $274.57

Cap Rate 6.01% NOI $240,000

Lease Options Ten, Five-Year Options

Courtesy of Marcus & Millichap

ABS NET LEASE DRUG STORE 9.75% CAP 11,648 SF CHEEKTOWAGA (BUFFALO MSA),NY

Asking Price: $3,098,000

Property Type Retail Investment Type Net Lease Lease Type Absolute NNN Tenant Credit Corporate Guarantee Tenancy Single

Square Footage11,648 Price/Sq Ft $265.97 Cap Rate 9.75% NOI $302,033 Year Built 2000 Lot Size (acres)1.25 Courtesy of Marcus Millichap

Rite Aid 7.50% CAP | 12,000 SF | YORKSHIRE, NY

Asking Price: $2,628,000

Investment Type Net Lease Investment Lease Type NN

Tenant Credit Corporate Guarantee Tenancy Single

Rent 06/25/1996 - 03/31/2029 Remaining Term 9.3 years

Square Footage 12,000 Price/Sq Ft $219 Cap Rate 7.50%

Occupancy 100% NOI $197,100 Year Built 1997

Buildings 1 Lot Size (acres)1.19

Rent Bumps In Option Periods

Lease Options (1) Five Year Option

Courtesy of Encore Real Estate

Rite Aid 7.10% CAP 14,375 SF BALLSTON LAKE, NY

Asking Price: $3,795,000

Property Type Retail Lease Type NNN

Tenant Credit Corporate Guarantee, Credit Rated

Tenancy Single Lease Expiration 06/30/2025

Remaining Term 5.6 years Square Footage 14,375

Price/Sq Ft $264 Cap Rate 7.10% NOI $269,519

Year Built 2004 Stories 1 Zoning Commercial

Lot Size (acres) 7.96 Parking (spaces) 72

APN 414089 250.-1-38.1 Lease Options 4, Five-Year

Courtesy of Marcus Millichap

Rite Aid NNN Lease Cap Rate 8.50% CAP 13,813 SF JAMESTOWN, NY

Asking Price: $3,816,047

Property Type Retail Lease Type NNN Tenant Credit Corporate Guarantee Tenancy Single

Lease Term 20 years Lease Commencement 12/09/2003 Lease Expiration 12/08/2023 Remaining Term 4 years

Square Footage 13,813 Price/Sq Ft $276.26 Cap Rate 8.50% NOI $324,364 Lot Size (acres)1.54

Rent Bumps 2% Each Five Year Option Period Lease Options 4 - Five Year Options Ownership Fee Simple Courtesy of Marcus & Millichap

pleased to present for sale this Net Leased Rite Aid located at 811 North Main Street, Jamestown, New York in Chautauqua County, less than a hours drive due East of Erie, Pennsylvania and one hour drive South from Buffalo with an average household income exceeding $56,090, annually.

The subject property consists of 13,813 square feet situated on a large 1.54-acre-parcel of land with full service pharmacy drive-thru window and a Rite Aid Wellness Clinic within the store. This Rite benefits from the strategic location at the signalized intersection of North Main Street and West 8th Street. There is another Rite Aid across town at 50 South Main St. which is directly across the st. from a Walgreen’s (10 Prospect St) and a CVS (195 Main St).

There are over four years remaining on the original 20-year, Absolute-Net Lease (NNN) where the landlord has no responsibilities to the property. The offering provides a flat initial term with two percent increases in each of the four five-year option periods. There are also three access points and a drive-thru to make for a smooth customer experience with a traffic count over 17,500 vehicle per day. Other local retailers include; 7 Eleven, Friendly’s, CVS, Tim Horton’s, Cricket Wireless, TOPS Friendly’s Grocery Market and Aaron’s Rents to name a few.

Rite Aid Corporation is a retail drugstore chain in the United States and a Fortune 500 company. It is headquartered in East Pennsboro Township, Cumberland County, Pennsylvania, near Camp Hill. The Company’s segments include Retail Pharmacy and Pharmacy Services. The Company operates under The Rite Aid name. It operates approximately 2,525 stores in over 30 states across the country and in the District of Columbia. Rite Aid is the largest drugstore chain on the East Coast and the thirdlargest in the United States, employing roughly 89,000 associates. The company is publicly traded on the New York Stock Exchange under the ticker symbol RAD.

Rite Aid NNN 7.25% CAP | 13,813 SF | CORNING, NY

Asking Price: $4,513,972

Property Type Retail Lease Type NNN

Tenant CreditCredit Rated, Corporate Guarantee

Tenancy Single Lease Term20 years

Lease 09/09/2004 - 09/08/2024 Remaining Term 4.8 years

Square Footage 13,813 Price/Sq Ft $326.79 Cap Rate 7.25%

NOI $327,263 Year Built 2004 Lot Size (acres)2.1

Rent Bumps 2% Each Five Year Option Period

Lease Options 4 - Five Year Options

Ownership Fee Simple Courtesy of Marcus Millichap

Rite Aid 7.00% CAP | 10,908 SF | ELMIRA, NY

Asking Price: $4,148,257

Property Type Retail Investment TypeNet Lease

Lease Type NN Tenancy Single

Lease Expiration 11/29/2028 Remaining Term 9 years

Square Footage 10,908 Price/Sq Ft $380.29

Cap Rate 7.00% NOI $290,378Units 1

- 40,000 people live within three miles of the property

- Very strong store sales with low rent to sales ratio

Long operating history at the location since 1999

Courtesy of The Boulder Group and Lee & Associates

Rite Aid 7.15% CAP | 11,695 SF | BALDWINSVILLE, NY

Asking Price: $2,894,993

Property Type Retail Lease Type NN Tenancy Single Lease Expiration 08/17/2028 Remaining Term 8.7 years

Square Footage 11,695 Price/Sq Ft $247.54 Cap Rate 7.15% NOI $206,992Units 1

Marketing Description

The Boulder Group is pleased to present for sale a single tenant Rite Aid located in Baldwinsville, New York.

- Located at the hard corner of a signalized intersection

- Long operating history at the location

- Rite Aid extended their lease early in 2018, illustrating their commitment to the site

- Well above average sales at this location with a very low rent to sales ratio

- Positioned along a primary east-west thoroughfare (15,864 VPD)

- Immediately off of State HWY 690 (18,946 VPD)

Rite Aid NNN - SUBLEASED TO DOLLAR TREE 7.75% CAP | 14,564 SF | COHOES, NY

Asking Price: $3,383,000

Sub Type Drug Store Investment Type Net Lease

Lease Type Absolute NNN Corporate Guarantee Tenancy Single

Lease Term 20 years Lease 06/01/2007 to 05/31/2027

Remaining Term 7.5 years Net Rentable (sq ft)14,564

Price/Sq Ft $232.29 Cap Rate 7.75% Occupancy 100% NOI $262,152

Units 1 Year Built 2006 Buildings 1 Stories 1 Zoning Commercial

Lot Size (acres) 1.29 Rent Bumps In Options Lease Options Four 5-Year

Ownership Fee Simple Courtesy of Marcus Millichap

Walgreens 15 Year NNN Lease 6.25% CAP 13,813 SF HORNELL, NY

Asking Price: $5,398,064

Lease Type NNN Tenant Credit Credit Rated, Corporate Guarantee

Tenancy Single Lease Term 20 years

Lease 02/02/2025 -03/31/2034 Remaining Term 14.3 years

Square Footage 13,813 Price/Sq Ft $390.80

Cap Rate 6.25% NOI $337,379

Lot Size (acres)1.71 Rent Bumps No

Lease Options4 - Five Year Options

Ownership Fee Simple Courtesy of Marcus Millichap

Rite Aid 7.15% CAP | 10,147 SF | BARNEGAT TOWNSHIP, NJ

Asking Price: $2,570,098

Property Type Retail Lease Type NN Tenancy Single Lease Expiration 03/31/2029 Remaining Term 9.3 years

Square Footage 10,147 Price/Sq Ft $253.29 Cap Rate 7.15% NOI $183,762 Units 1

The Boulder Group is pleased to exclusively market for sale a single tenant Rite Aid property located in Barnegat, New Jersey.

Rite Aid 7.15% CAP 10,147 SF BARNEGAT TOWNSHIP, NJ

Asking Price: $2,570,098

Property Type Retail Lease Type NN Tenancy Single

Lease Expiration 03/31/2029 Remaining Term 9.3 years

Square Footage 10,147 Price/Sq Ft $253.29

Cap Rate 7.15% NOI $183,762 Units 1

Courtesy of The Boulder Group

Rite Aid 7.95% CAP | 11,136 SF | CLEMENTON, NJ

Asking Price:$2,385,622

Property Type Retail Investment Type Net Lease

Lease Type Absolute NNN Tenancy Single

Rent 05/30/1997 - 05/31/2024 Remaining Term 4.5 years

Square Footage 11,136 Price/Sq Ft $214.23 Cap Rate 7.95%

Occupancy 100% NOI $189,657 Year Built 1997

Lot Size (acres)1.5 Lease(1) Five Year Option - By Encore R.E

Rite Aid Portfolio - Four Properties UPSTATE NEW YORK

Asking Price: $17,232,046

4433 Dewey Ave, Rochester, NY 14616 & 4155 West Main Street, Batavia, NY 14020

2561 Union Road, Cheektowaga, NY 14227 & 1454 Union Road, West Seneca, NY 14224

portfolio of Rite Aid Pharmacies located in upstate New York. All subject properties are 100% leased to Rite Aid and are operating under recently extended NN leases. The portfolio is being sold as a package, with the in-place financing.

- Portfolio includes four Rite Aid locations between Buffalo, NY and Rochester, NY.

- Each location has approximately eight years of lease term remaining, followed by four 5-year options.

- Average rent per square foot is $23.58, which is significantly lower than comparable drug store locations.

- All locations are at signalized corners in dense markets, on roads with high traffic counts.

- Properties are cross-collateralized with an attractive loan that is well below current market interest rates | Investors will receive double digit cash-on-cash returns.

- Ideal for 1031 exchange buyers looking to leverage proceeds into multiple strong performing assets.

Rite Aid 7.10% CAP 10,908 SF BELLE VERNON, PA

Asking Price: $4,241,338

Property Type Retail Lease Type Absolute NNN Tenancy Single

Lease Expiration 10/26/2027 Remaining Term 7.9 years

Square Footage 10,908 Price/Sq Ft $388.83 Cap Rate 7.10%

NOI $301,135 Units 1 Year Built 1998

Courtesy of The Boulder Group

Rite Aid 8.75% CAP 11,201 SF ERIE, PA

Asking Price:$1,459,026

Property Type Retail Investment Type Net Lease

Class A Lease TypeNN Tenancy Single

Lease Expiration 11/06/2023 Remaining Term 3.9 years

Square Footage 11,201 Price/Sq Ft $130.26

Cap Rate 8.75% NOI $127,665 Year Built 1998

Rite Aid / Subway |10.00% CAP | 10,500 SF | ALTOONA, PA

Asking Price: $1,304,458

Property Type Retail Lease Type NNN Tenancy Multi Remaining Term 5 years

Square Footage 10,500 Price/Sq Ft $124.23 Cap Rate 10.00% NOI $130,445 Units 3

For sale this Rite Aid anchored strip center located on East Pleasant Valley Boulevard in Altoona, Pennsylvania. Rite Aid has 6 years remaining on its initial 10 year NNN lease with two, five year options to renew. There are currently limited landlord responsibilities, making this an easy to own and operate property for the real estate investor looking for more yield. The building is well maintained block-on-block construction which helps to alleviate deferred maintenance in the near future. This is a value-add, multi-tenant opportunity leaving an upside for the next owner through leasing of the vacant space and possibly converting the Subway lease to NNN. courtesy of CBRE

4530 N 5th St 6.25% CAP 14,564 SF PHILADELPHIA, PA

Asking Price: $5,800,000

Property Type Retail Lease Type Absolute NNN Tenancy Single

Lease Term 25.1 years Lease 09/16/2005 - 09/30/2030

Remaining Term 10.8 years Square Footage 14,564

Price/Sq Ft $398.24 Cap Rate 6.25% NOI $362,500

Lot Size (acres) 2.03 APN 88-2-7567-10

Lease Options 5-5 Year Options Colliers International

Rite Aid 7.35% CAP 10,163 SF NEW BETHLEHEM, PA

Asking Price: $1,904,762

Property Type Retail Investment Type Net Lease

Lease Type NN Tenancy Single

Lease Expiration 08/31/2024

Remaining Term 4.7 years

Square Footage10,163 Price/Sq Ft $187.42

Cap Rate 7.35% NOI $140,000 Units 1

The Boulder Group and Lee & Associates

Rite Aid 6.00% CAP | 11,186 SF | MCKEES ROCKS, PA

Asking Price: $7,405,000

Property Type Retail Lease Type NN Tenant Credit Corporate Guarantee, Credit Rated Tenancy Single

Lease Expiration 02/29/2036 Remaining Term 16.2 years Square Footage 11,186 Price/Sq Ft $661.99 Cap Rate 6.00%

NOI $444,304 Year Built 2016 Lot Size (acres) 1.602 Lease Options Six, Five (5) Year Ownership Fee Simple

Rite Aid Corporation (Nyse: Rad) is one of the nation’s leading drugstore chains and ranked 107 on Fortune 500’s Largest U.S. Corporations, with fiscal 2018 annual revenues of $21.6 billion and a current credit rating of B3. Rite Aid is one of the largest drugstore chains on the East Coast, with approximately 2,466 stores in 19 states, employing more than 48,000 associates across the country.

Rite Aid began in 1962 as a single store opened in Scranton, Pennsylvania named Thrift D Discount Center. After several years of growth, Rite Aid adopted its current name and debuted as a public company in 1968. In 2018, Walgreens Boots Alliance acquired 1,932 Rite Aid stores for $4.38 billion.

In June 2019, Amazon announced the launch of an Online purchase pick-up service at designated counters inside more than 1,500 Rite Aid stores across the U.S. Also in June, Rite Aid announced a new partnership with Adobe to combine personalized health and wellness expertise with digital operational support, seamlessly connecting the pharmacy, retail stores and Online customer experience. Rite Aid will also partner with UNFI to introduce natural and organic items in-store. Rite Aid is extending their partnership with GNC Health through 2021. Beyond their stores, Rite Aid brings the company’s mission to life through the efforts of The Rite Aid Foundation. Through their long-standing support of Children’s Miracle Network Hospitals and other Rite Aid Foundation efforts, the company has raised and donated over $100 million to kids and their families. Courtesy of Marcus of Millichap

RITE AID W/ D-THRU PHARM | ABS NNN LEASE 9.50% CAP | 14,471 SF | DUBOIS, PA

Asking Price: $3,328,295

Property Type Retail Investment Type Net Lease Lease Absolute NNN Tenant Credit Corporate Guarantee Tenancy Single

Square Footage 14,471 Price/Sq Ft $230 Cap Rate 9.50% NOI $316,188 Year Built 2003 Lot Size (acres) 1.76 Courtesy of Marcus Millichap

Rite Aid - 10.11% CAP 24K+ VPD CONWAY, PA

Asking Price : $2,750,000

Investment Type Net Lease Absolute NNN Corporate Guarantee Tenancy Single Lease Term 23.9 years Lease 07/15/1999 - 06/06/2023 Remaining 3.5 years Sq Ft 10,908 Price/Sq Ft $252.11Cap Rate 10.11% Occupancy 100% NOI $278,142 Year Built 1999 Lot Size (acres)1.11 Ownership Fee Simple Courtesy of Marcus Millichap

FOR SALE RITE AID 503 CLIFTON RD. BETHEL PARK, PENNSYLVANIA

We're pleased to offer the fee simple interest in a freestanding Rite Aid in Bethel Park, Pennsylvania. The property is strategically located on the corner of two heavily traveled thoroughfares; McMurray Rd and Clifton Rd. The building is on a 1.32-acre parcel of land and is improved with a 11,115-square foot retail pharmacy which includes a drive through.

This building was constructed in 2018, and Rite Aid signed a 20 Year lease in September of 2018. With 19.25 Years of initial term remaining, and an additional six (6) five (5) year options to renew, this is a steady investment with passive cash flow for an investor.

INVESTMENT HIGHLIGHTS

•$5,833,000 / $525 / 6% Cap Rate •20 – Year Corporate Backed Lease with 19.25 Guaranteed Years Remaining - Courtesy of CBRE

•Long Term Lease with a National Credit Tenant – Rite Aid (Moody’s Credit Rating B2)•Offered Free and Clear of Existing Debt

•Rent escalates 10% every ten (10) years of term and continues to escalate during renewal periods. •New 2018 High-Quality Brick Construction

Rite Aid OM Downloads

Our Triple Net Pharmacy Listings and Partners

Copyright © 2019 LeeRG.com by Lee Group LLC - All Rights Reserved

- About Us

- Services

- Manhattan NYC

- Brooklyn NY

- Miami FL

- International

- Manhattan NYC

- Brooklyn, NY

- Australia

- Canada

- Dubai

- London & Europe

- South Korea

- By Developers

- Luxury Rentals

- Manhattan NYC

- Ritz-Carlton Residences

- Four Seasons Residences

- Mandarin Oriental & Shang

- St.Regis Residences & Etc

- Viceroy Residences

- Bvlgari & W Residences

- Branded Residences

- New York New Homes

- New Jersey New Homes

- Connecticut New Homes

- California New Homes

- Florida New Homes

- Canada New Homes

- Exclusive Listings

- Offices

- Development Site

- Hotels & Hospitality

- Golf Courses & Resorts

- Triple Net Banks For Sale

- Triple Net Pharmacy

- Triple Net Retails

- Triple Net Restaurants

- Triple Net Starbucks

- Blog, News & Media

- Buyer's & Renter's Guide

- Neighborhoods

- Opportunity Zone

- Cruise,Yacht,Limo Service

- Luxury Shopping Services

- Private Jet Services

- Contact Us

Powered by Lee Group LLC